New Construction and Renovation Will Shape The Future of Nashville

Nashville has been the “It” city for the better part of this current economic cycle.

Increased population in the last few years - as high as 100 people per day at the peak - has led to Nashville’s economy outperforming the nation in many ways, but especially in terms of job growth and unemployment. Although record numbers of people are moving to the Greater Nashville Area, the city’s unemployment rates remain below historic averages at just over 2%.

Pretty remarkable to ponder, considering companies like Amazon, Smile Direct Club, AllianceBernstein, and Ernst & Young have accounted for nearly 10,000 new jobs added in the last year and a half, alone. Not to mention all of the ancillary and complimentary companies and startups that will be flocking to the Nashville market to serve those companies in various capacities.

Demand for New Construction Spikes

As Nashville consistently ranked at the top of various publications’ lists, confidence in Metro Nashville’s future as a business district skyrocketed. Coupled with Tennessee’s lack of a state income tax and the government’s willingness to provide incentives, Nashville was a powder keg waiting to explode.

Developers’ certainty in a successful future manifested in 2017, in which more office space was delivered that year than the previous few years combined - nearly 1.5 million square feet. Since then, Nashville has been on the radars of investment and development groups from not only other states, but other countries. In fact, Canadian investors were among the most aggressive in Nashville acquisitions in 2017.

Multiple, billion dollar projects - previously unheard of in Nashville - are now underway, including Century Farms (300+ acre mixed-use development) and Nashville Yards (the largest development ever in Downtown Nashville and the future home of Amazon).

Yet Vacancies Remain at Historic Lows

Despite millions of square feet of buildings being added to Nashville’s inventory, vacancy rates remain well below historic averages. Nashville’s twenty-year office vacancy average sits slightly below 10% of market inventory and we’re at just under 6% at the moment (compared to 14.2% nationally).

It’s obvious that Nashville is one of the most in-demand cities in the country for office space.

And with demand having outpaced supply in the last few years, rent rates have also risen. The Nashville average price per square foot in 2015 was $22.45 vs $29.19 at the start of 2020 - an increase of 30% in just five years.

Small business owners and startups are beginning to get priced out of the market.

Due to the high costs of land and construction in Nashville, developers must recoup these costs plus their return on investment by passing expenses on to tenants through rental rates. When projects like Broadwest are delivering office space at $40.00+ per square foot, the local businesses that have helped create Nashville’s culture get pushed out to the edges of the city or are forced to shut down completely.

However, as my partners and I have explored this past year, we don’t always need new construction to help alleviate our lack of high-quality inventory.

Bringing New Life to Existing Commercial Real Estate

Having represented a number of small business owners searching for space in Nashville, I knew that pricing had become an issue far before anyone started talking about it.

We had clients who were forced to move by litigious landlords simply because the landlord felt they could get higher market rates without that tenant. We’ve also had clients seek to open their second or third location only to find that rents would be nearly twice what they were currently paying, causing them to alter their search or abandon it altogether.

These instances pushed me to find a way to solve our clients’ issues. If entrepreneurs couldn’t make it in Nashville, where would our city be in the next 5, 10, or 15 years? Sure, purchasing is an option, but the average sales prices has doubled in the last 10 years.

Tapping into Nashville’s Class C Inventory

We at The Cauble Group estimate that there are over 6,500+ commercial buildings in Nashville built before 1990. While the majority of this inventory is occupied, a number are sitting vacant or partially vacant and haven’t been renovated in quite some time - if not since their construction!

These buildings give investors a new opportunity - to find product at well below replacement or new construction costs, renovate the project, and bring commercial suites to market at highly competitive rates.

Not only are these buildings a prime opportunity for investment, they solve several crucial issues in our community: sustainability, affordability, and congestion.

Bringing the Value-Add Model to Commercial Real Estate

Having spent quite a bit of time with multifamily investors and syndicators, I became very familiar with the value-add model of investing. Essentially, multifamily investors seek opportunities to add value to the project in order to increase their returns, whether it be through operational efficiencies, renovations, or amenity additions. I realized that while this was commonplace on the multifamily front, I had hardly seen anyone doing it in commercial. Why was that?

Turned out many investors were worried about the risk associated with vacant or mostly vacant buildings.

While having a non-income producing (or close to it) asset would certainly cause some heartburn, that risk could be avoided with the right financing. The banks we’ve worked with are willing to grant an 18 to 24 month interest only period with interest carry in the loan. In this scenario, if you’re looking at around 18 months to stabilize a property, you won’t come out of pocket for anything other than operating expenses until that interest only period comes to an end.

The Right Team, The Right Strategy

Having an aggressive lease up team and strategy is crucial for this model to work.

For us, it’s been helpful having the brokerage in house, as my agents know exactly what we’re working towards and how to attract the right tenant base. Strategically, we target small and local business owners who see an enormous amount of value in high quality yet affordable space.

We can renovate Class C properties to Class B or B-, often solely with cosmetic work, and then bring that product to market at below Class C market rental rates.

Operational efficiency is also crucial to keep costs low. By utilizing technology and making intelligent repairs and upgrades to our properties, Parasol Property Management is able to keep operating expenses below the Nashville market average.

Case Studies

4013 Travis drive

Purchased in June of 2018, this two-story, 12,070 square foot office building is located in a Class B location at Harding and Nolensville but hadn’t been renovated in nearly two decades.

We fully renovated the building, including: exterior elevations, paint / flooring on the interior, restrooms, kitchens, common areas, parking lot, landscaping, and security. These renovations were performed at around $21.00 per square foot after a purchase price of $81.00 per square foot - you could not build that building back for $150.00 per square foot plus the cost of the dirt.

Since our entry cost is so low, our leasing team at The Cauble Group was able to bring the suites to market at $16.00 per square foot net, which is 12.5% below Class C office rates in that area.

At the time of this post, 4013 Travis Drive is 6 months ahead of lease up schedule.

3250 Dickerson Pike

Acquired in the Fall of 2018, 3250 Dickerson Pike is a three-story, 28,000 square foot office building located just off Briley Parkway / I-65 in East Nashville. This building sat at 40% occupancy for two years prior to acquisition.

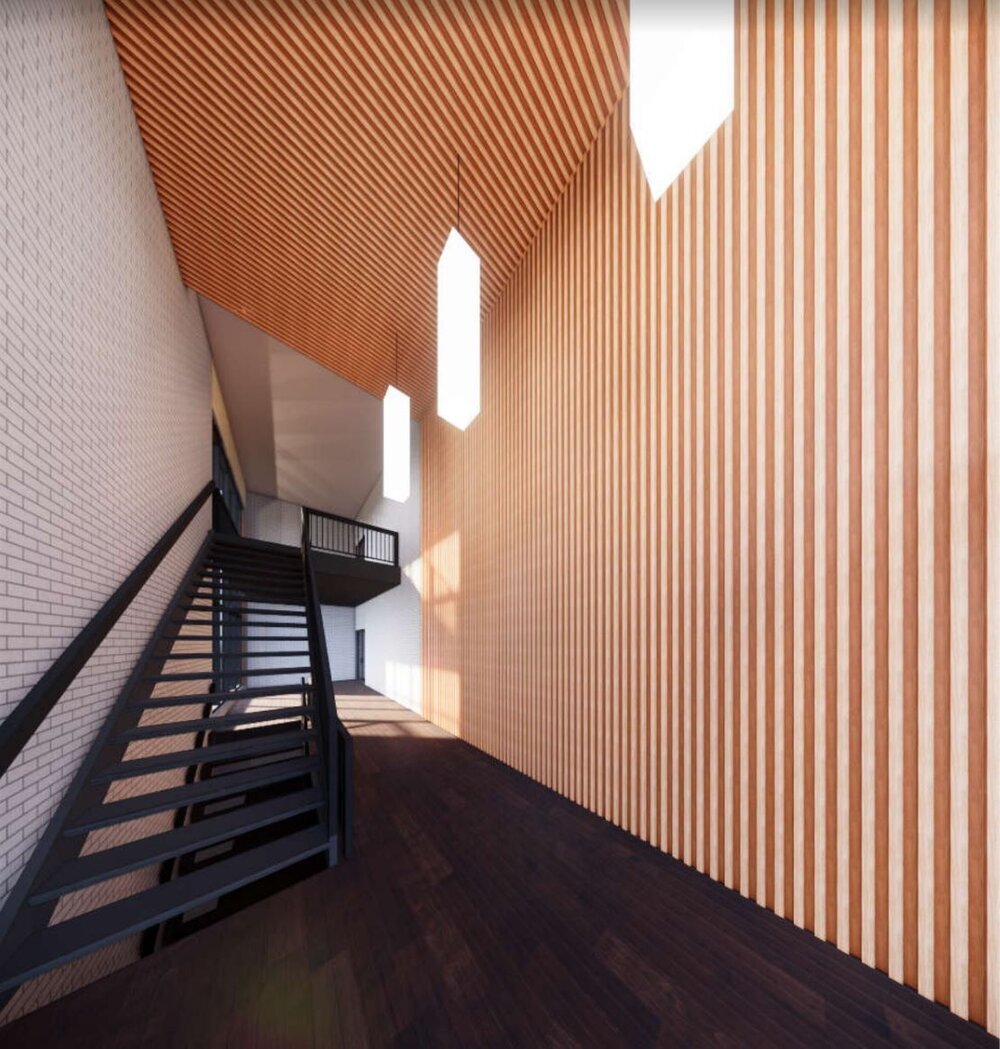

We’re about to begin renovations on the building, which will include a new exterior, updated common areas, and renovated suites for all new tenants. After renovations, this property will be in the Class B to B+ range.

The acquisition price for this project, which we haven’t disclosed, is very close to Travis. We will be spending around $26.00 per square foot to renovate the property, which has been brought to market for lease at $20.00 per square foot - 10% to 15% under market rates.

At the time of this post, The Cauble Group has leased a suite to State Farm with several others in the works.

About The Author:

Tyler Cauble, Founder & President of The Cauble Group, is a commercial real estate broker and investor based in East Nashville. He’s the best selling author of Open for Business: The Insider’s Guide to Leasing Commercial Real Estate and has focused his career on serving commercial real estate investors as a board member for the Real Estate Investors of Nashville. Learn more at www.TylerCauble.com

Leveraging precise market knowledge not only differentiates brokers from the competition but also builds trust with clients who expect strategic insights and a deeper understanding of market dynamics.