Commercial Real Estate Tools and Resources

Take Your Investing Skills to The Next Level

Gain the knowledge and confidence to start Buying

Commercial Properties

Find, Fund, and Close Your First Commercial Real Estate Deal - Even If You’re Starting From Scratch

With my proven blueprint, personalized coaching, and lifetime access to my comprehensive training platform, you'll go from novice to pro in no time. Join my exclusive community of successful investors and start building the generational wealth and financial freedom you deserve.

Commercial Rent Calculators

Cap Rate Calculators

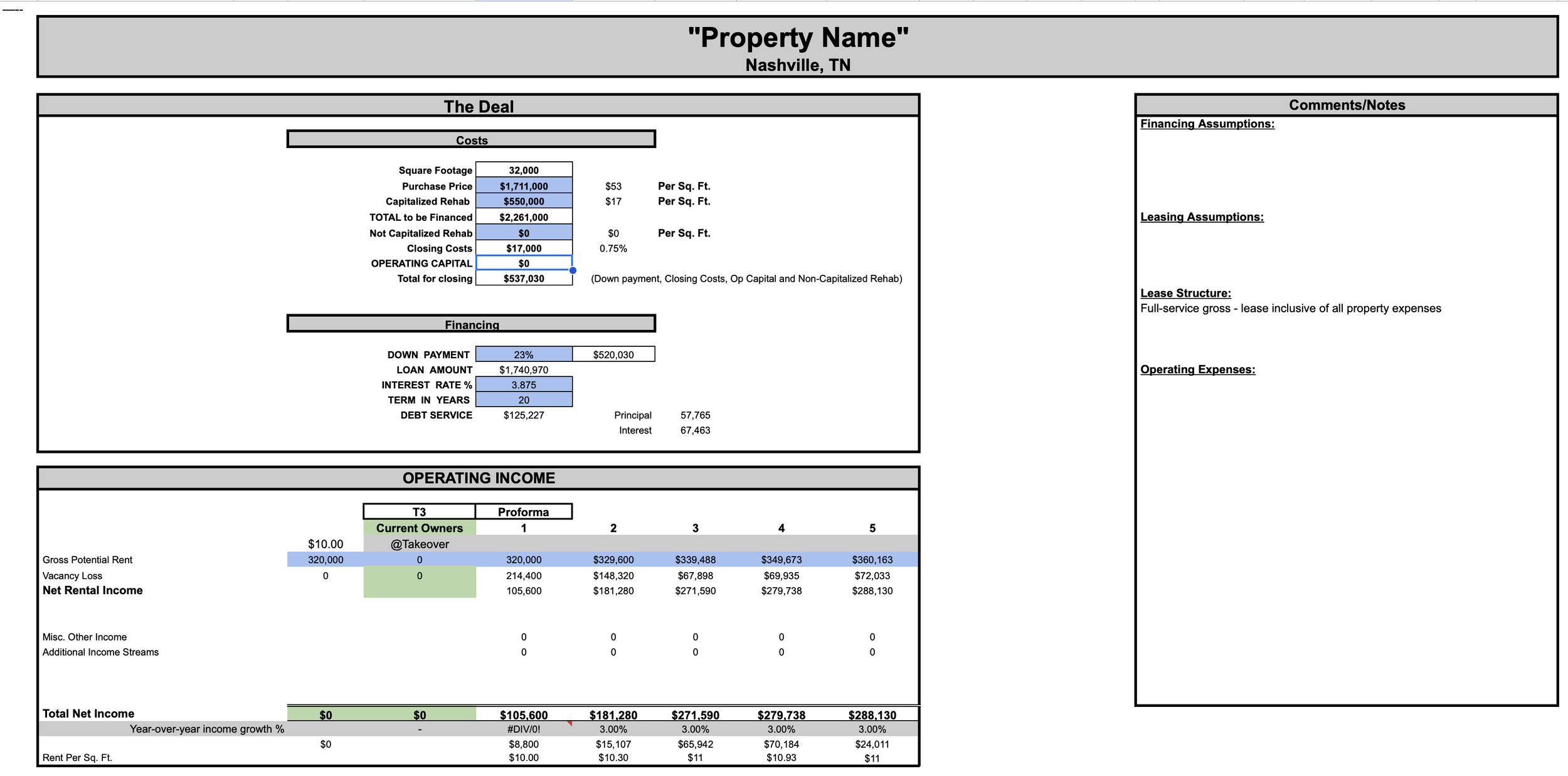

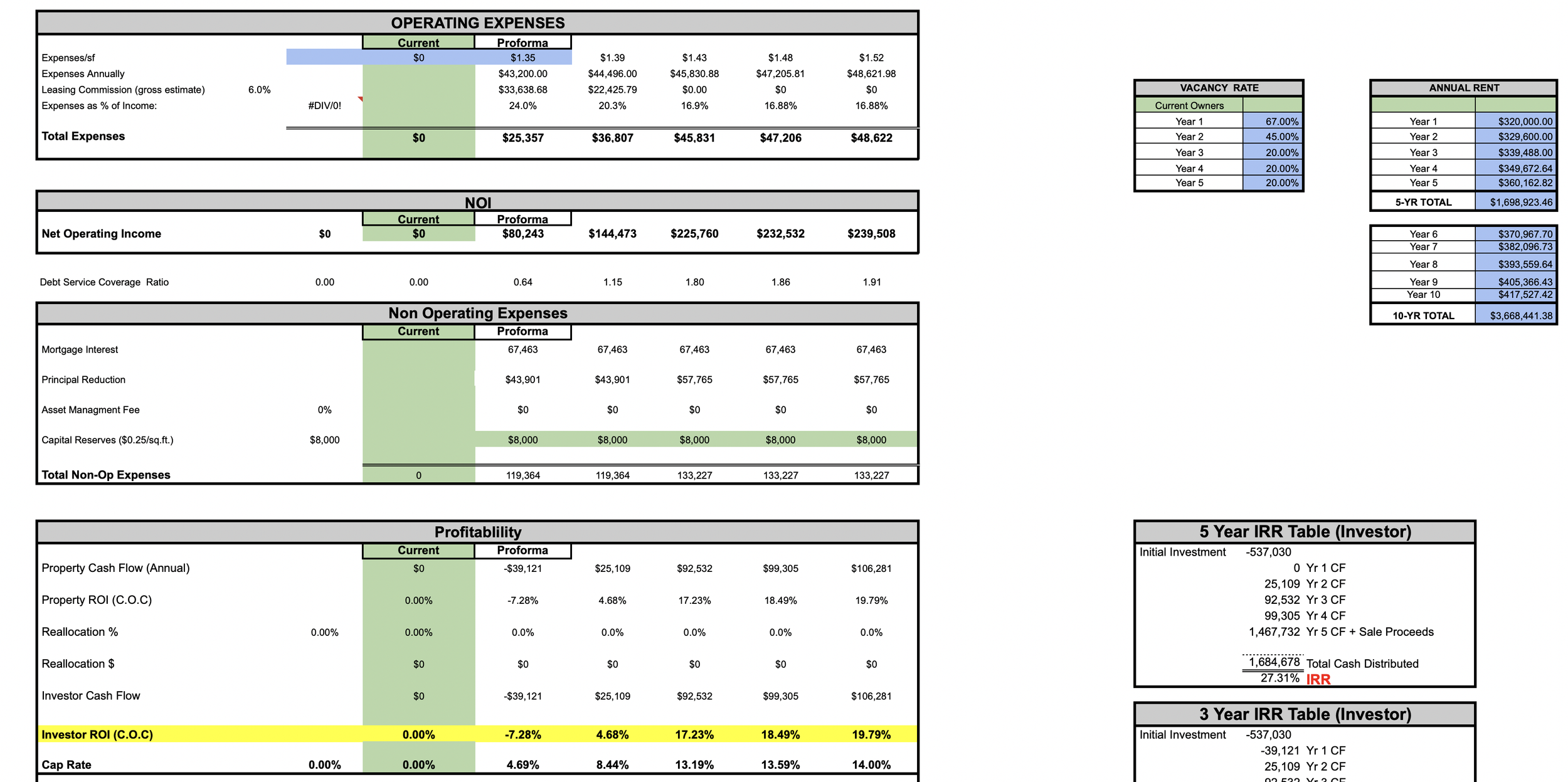

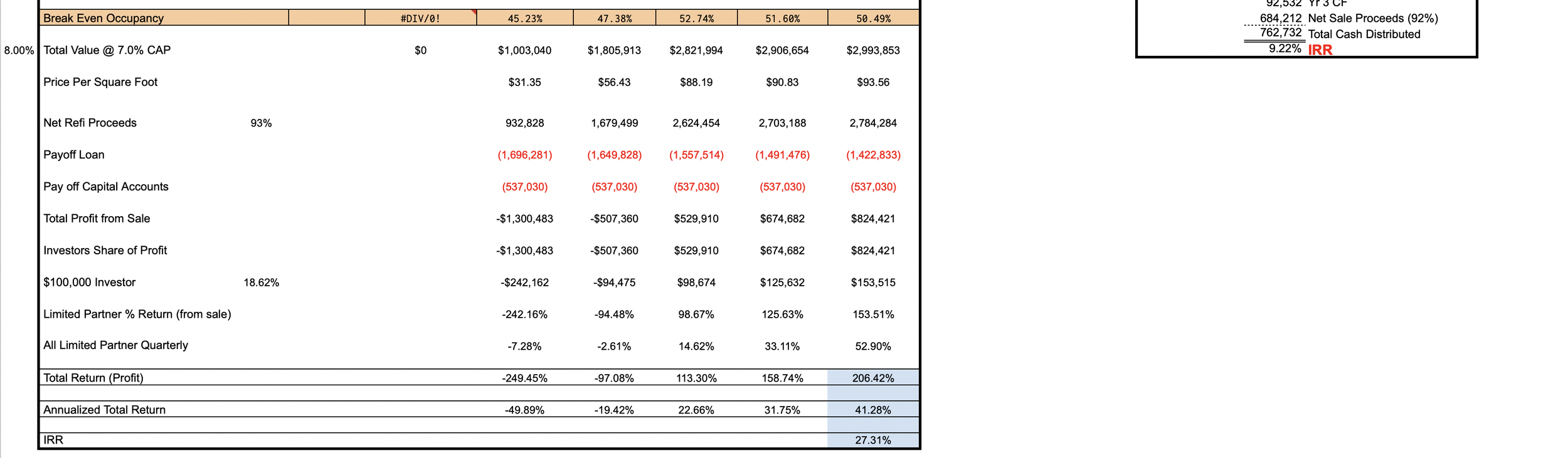

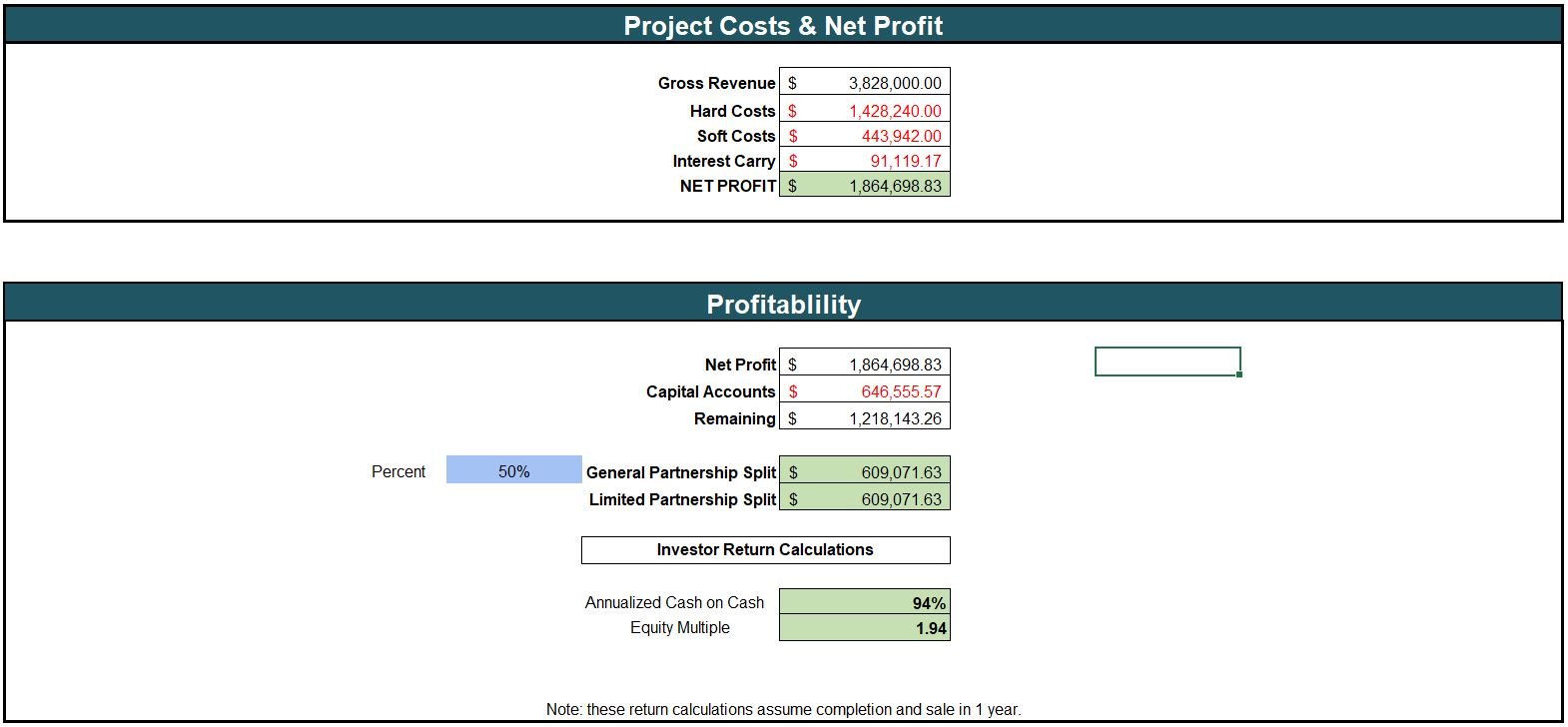

The Back of Napkin Underwriting Model

This model is a solid “rough and dirty” underwriting spreadsheet that keeps everything simple to help you determine quickly whether a deal is worth pursuing or not.

You’ll be able to take the rents collected, subtract your expenses, determine debt service coverage ratio, and your cash on cash returns.

About This model:

Excel file download that will be emailed directly to you upon purchase

Input your project assumptions in the blue tabs

Important numbers are highlighted in the green tabs

Quickly underwrite any deal to determine the potential cash flow and Debt Service Coverage Ratio

Works for all asset types: office, retail, industrial, hospitality, multifamily

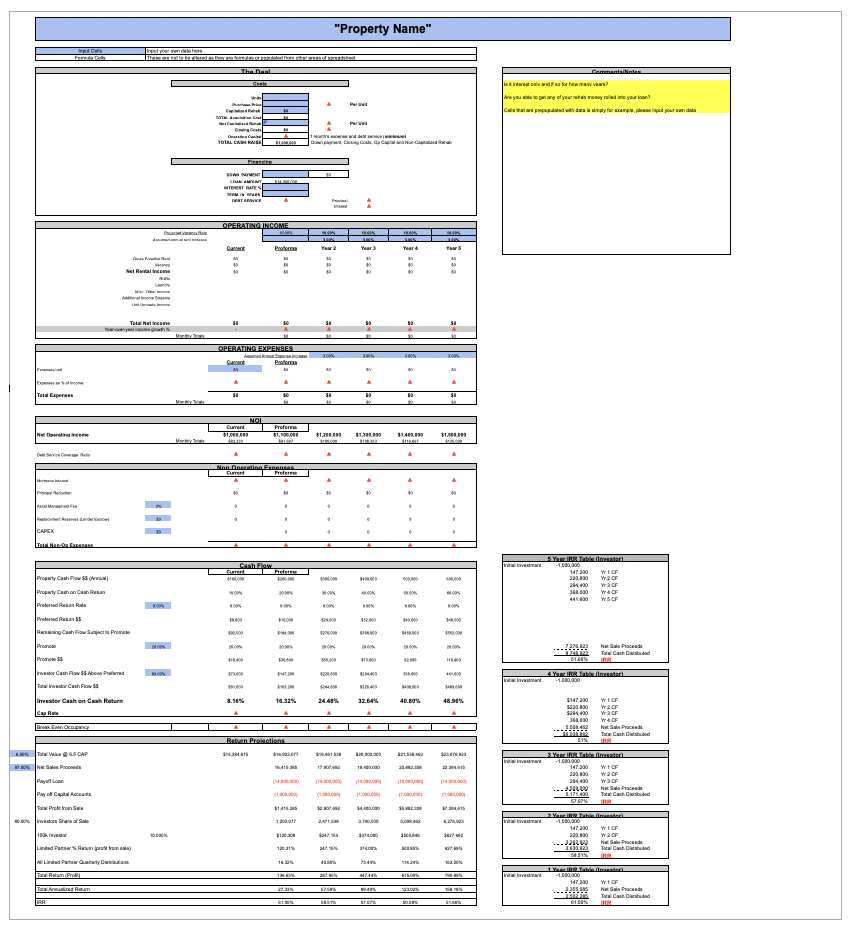

The Commercial Underwriting Model

Looking to step up your investment game with more detailed underwriting? With this commercial real estate underwriting template, you’ll quickly be able to determine whether or not a deal makes sense as an investment.

Simply input the total square footage of the asset, purchase price and closing costs, anticipated rents and any increases, your anticipated mortgage costs, and any other operating expenses to calculate the potential investment’s cash on cash and internal rate of return. This spreadsheet is designed to work on office, retail, and industrial real estate investments.

About This Model:

Excel file that will be emailed directly to you upon purchase

Input project assumptions in the blue boxes

Use for office, retail, industrial assets

Determine your cash flow, debt service coverage ratio, investor (LP) returns, deal sponsor (GP) returns and more

The model has notes throughout to guide you, as well as an hour long training video to show you how to use it

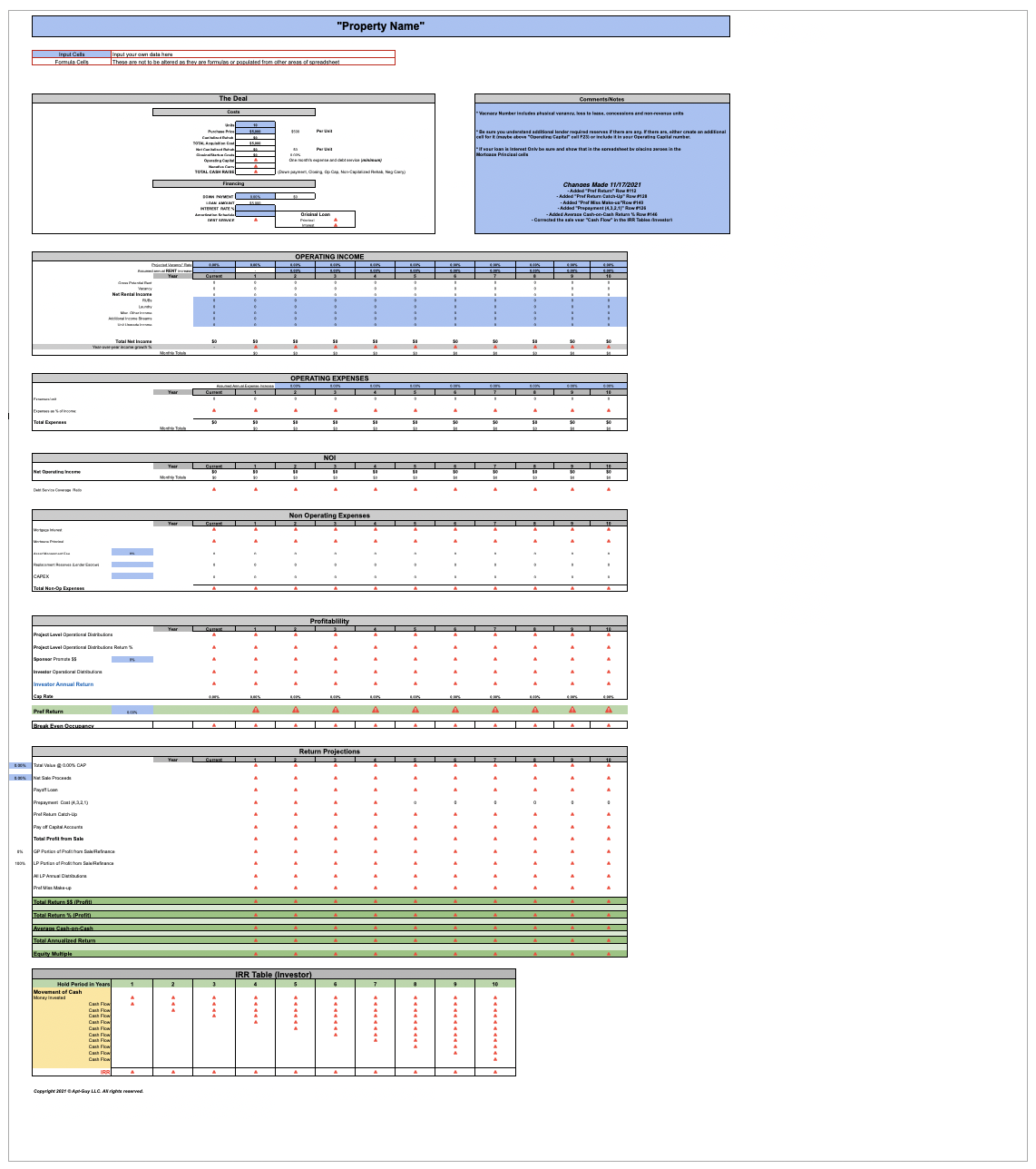

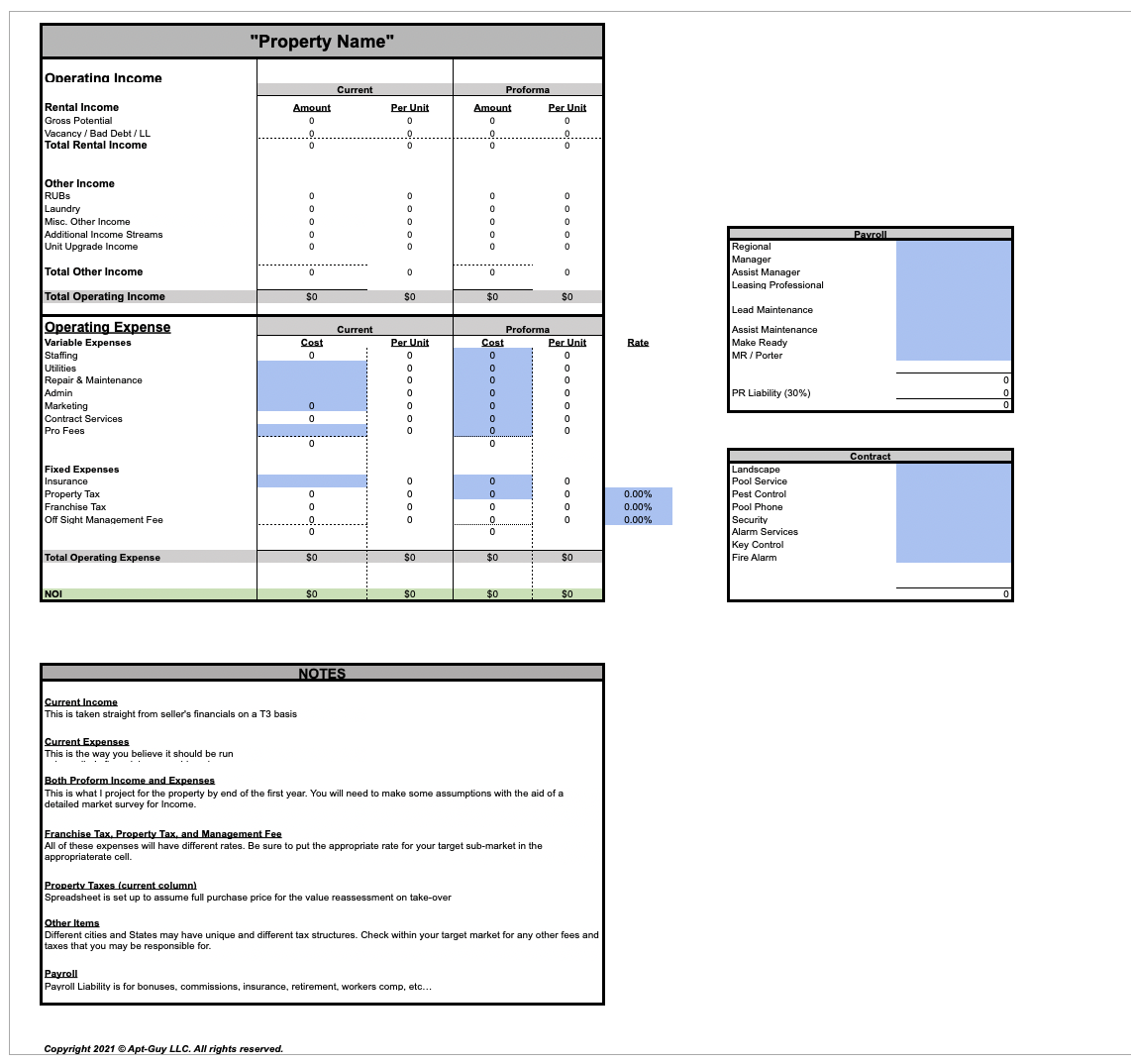

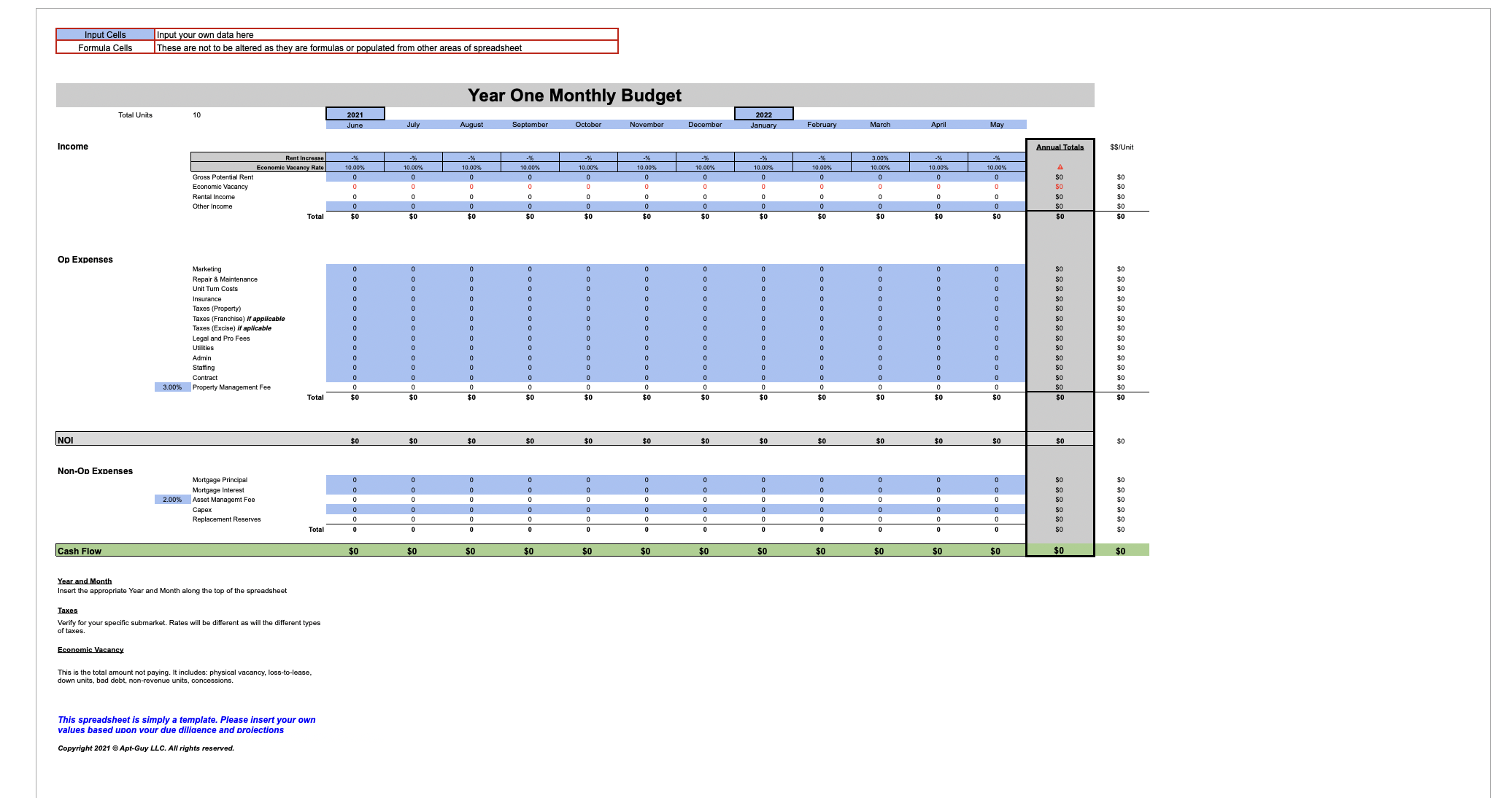

The Multifamily Underwriting Model

Are you interested in multifamily but don’t know how to run all the numbers? With this underwriting spreadsheet, you’ll quickly be able to determine whether or not a deal makes sense for you.

Simply input the number of units, purchase price and closing costs, anticipated rent and increases, your anticipated mortgage costs and other operating expenses to calculate the potential investments cash on cash and internal rate of return. This spreadsheet is designed to work on any type of multifamily asset, from two units to thousands.

About this Model:

Excel file that will be emailed directly to you upon purchase

Input project assumptions in the blue boxes

Use for multifamily assets

Determine your cash flow, debt service coverage ratio, investor (LP) returns, deal sponsor (GP) returns and more

The model comes with four (4) training videos

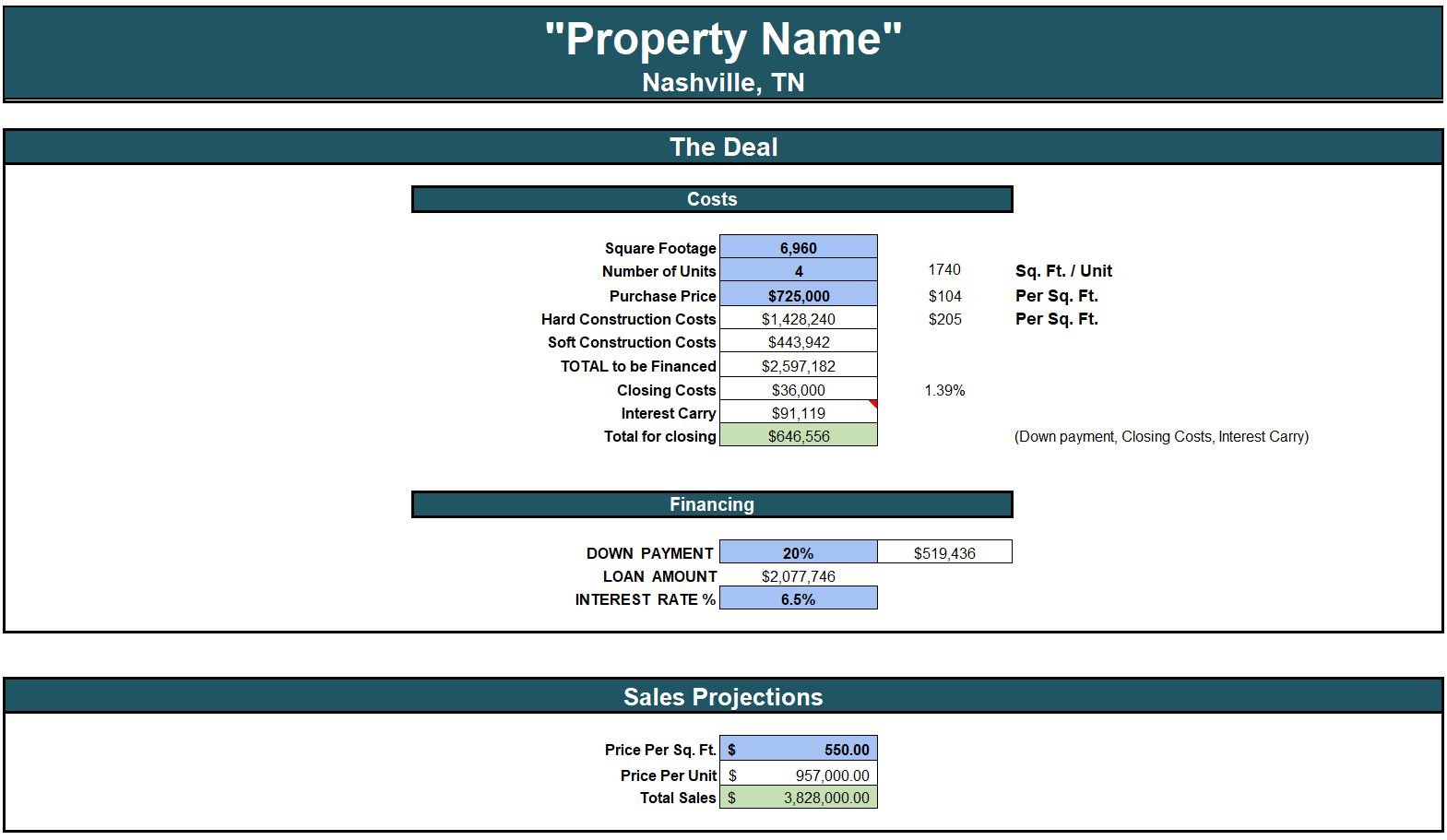

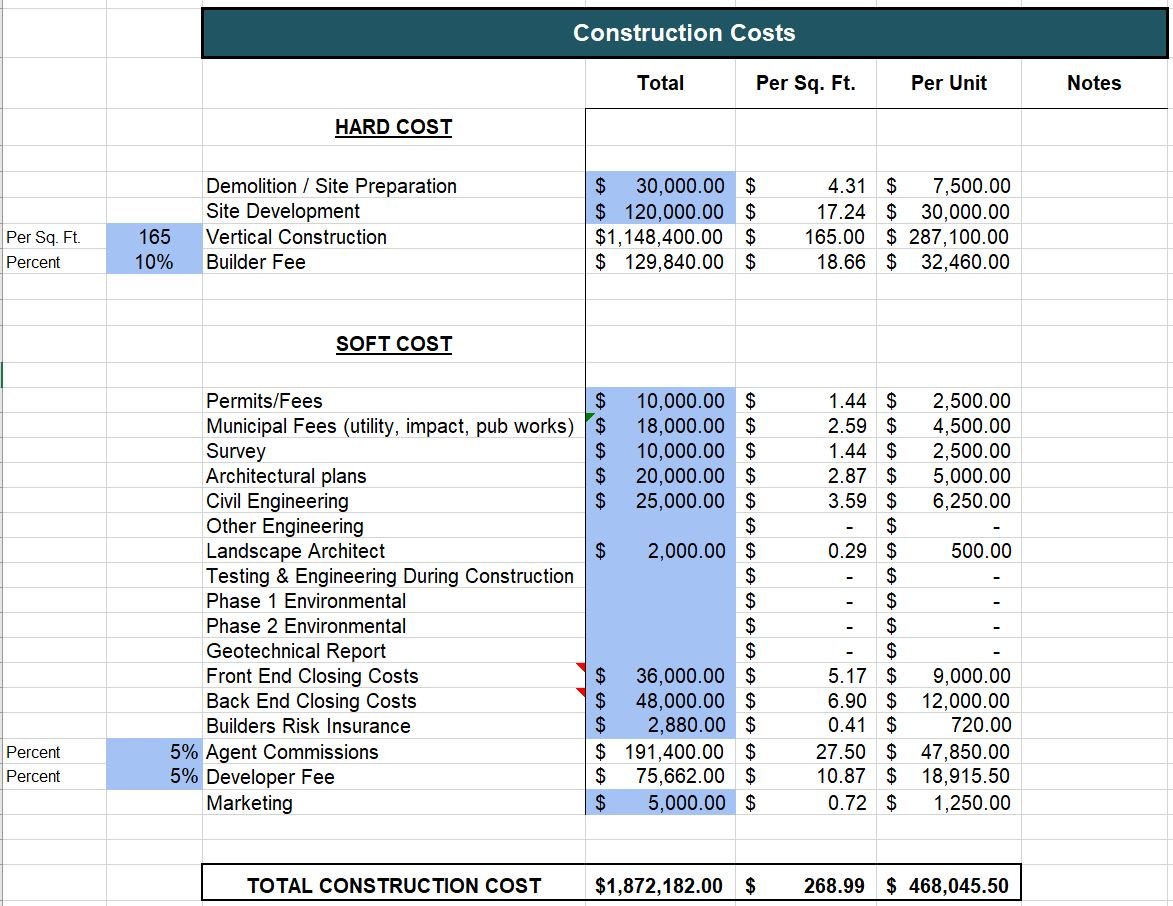

The Residential Development and Construction Underwriting Model

This model takes into account all costs associated with the project, including land acquisition, construction, and marketing expenses, as well as potential sales numbers and delivers you return on investment metrics to help you make an informed investment decision.

Whether you’re looking at building a single home or entire communities, this model is for you.

About this Model:

Excel file that will be emailed directly to you upon purchase

Input project assumptions in the blue boxes

Use for new construction residential developments

Input your development and construction costs, your anticipated build / sell period, and break out partnership returns between investors (LP) and deal sponsor (GP)

Simple format similar to our other models

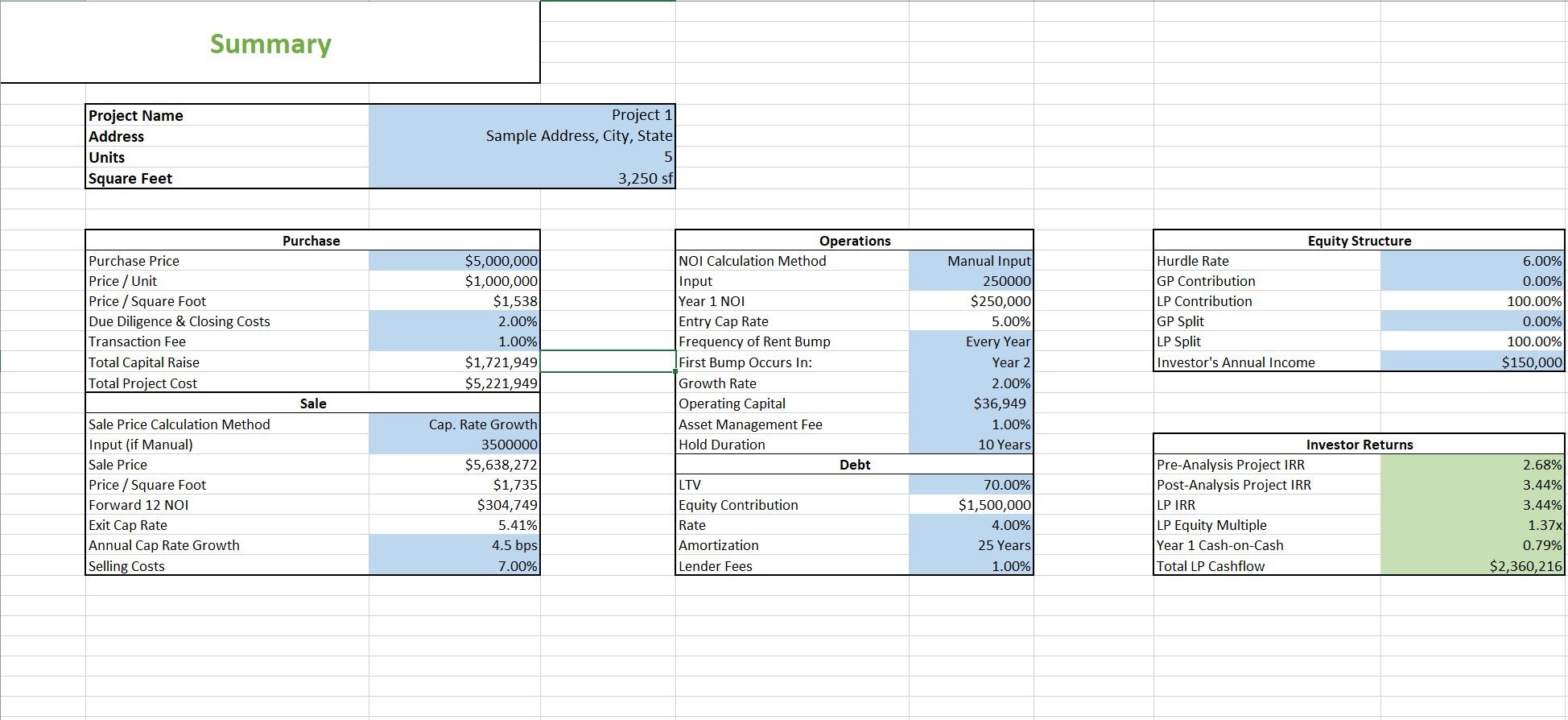

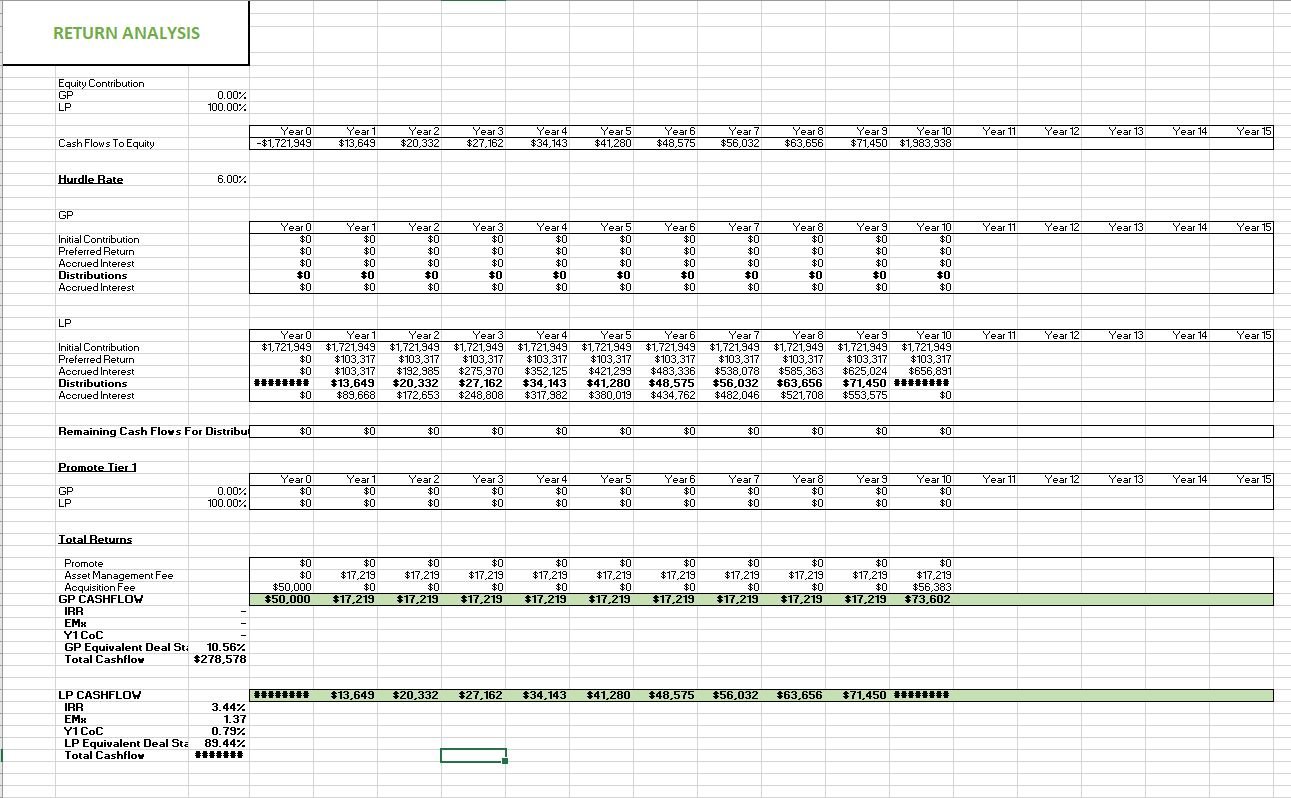

The Single-Tenant Net Lease Underwriting Model

Looking to step up your investment game with more detailed underwriting? With this triple net (nnn) real estate underwriting template, you’ll quickly be able to determine whether or not a deal makes sense as an investment.

Simply input the Net on Investment (NOI) of the asset, purchase price and closing costs, anticipated rent increases, your anticipated mortgage costs, and any other operating expenses (if any) to calculate the potential investment’s cash on cash and internal rate of return. This spreadsheet is designed to work on any triple net investments.

About This Model:

Excel file that will be emailed directly to you upon purchase

Input project assumptions in the blue boxes

Use for single tenant net lease investments (could also be used for multi-tenant net lease deals but the Commercial Spreadsheet may be better for that)

Input project numbers, determine investor returns, and see what a cost segregation study could do for this project (these are only assumptions and you will need to consult a cost seg specialist)

Simple format, easy to use and understand quickly

The Commercial & Multifamily Underwriting Bundle

Get 20% off our two most popular models with this bundle for the commercial and multifamily underwriting spreadsheets.

Click on the links above to see these underwriting models in action.

The All Model Bundle

Get 30% off all of our underwriting models with this bundle for the commercial, multifamily, and single-tenant net lease underwriting spreadsheets.

Note: this bundle does not include the residential development and construction model.

Free downloads

Due Diligence Checklist for Buying Commercial Property

As any seasoned investor will say, “you make your money in real estate when you buy it.” So, if that’s true, then making sure you’ve properly performed your due diligence before buying a property is critical to your success as an investor.

But there are so many aspects you have to know and what if you’ve never been through the process before?

Here’s a free download to Tyler’s step-by-step guide on commercial real estate due diligence.

Letter of Intent Template

This sample Letter of Intent is what we use here at The Cauble Group when leasing commercial space with both tenants and landlords. We’re providing you with a basic form LOI designed to work for a majority of commercial spaces and businesses.

This template features bold and highlighted text to guide you through how to set up the letter of intent for your use.

Open for Business: The Insider’s Guide to Leasing Commercial Real Estate

In this PDF version of his book, Tyler guides you through everything you need to know before renting commercial space. Whether you're looking for a new storefront, a location for your thriving business, or simply need to get out of the garage, Open for Business will show you how to determine space requirements, select a location, and negotiate your lease.

If you don't want to do it on your own, Tyler shares how to find a broker who can help you--and save you money!

Open for Business will demystify leasing commercial real estate and empower you to make the best decisions for your growing business.