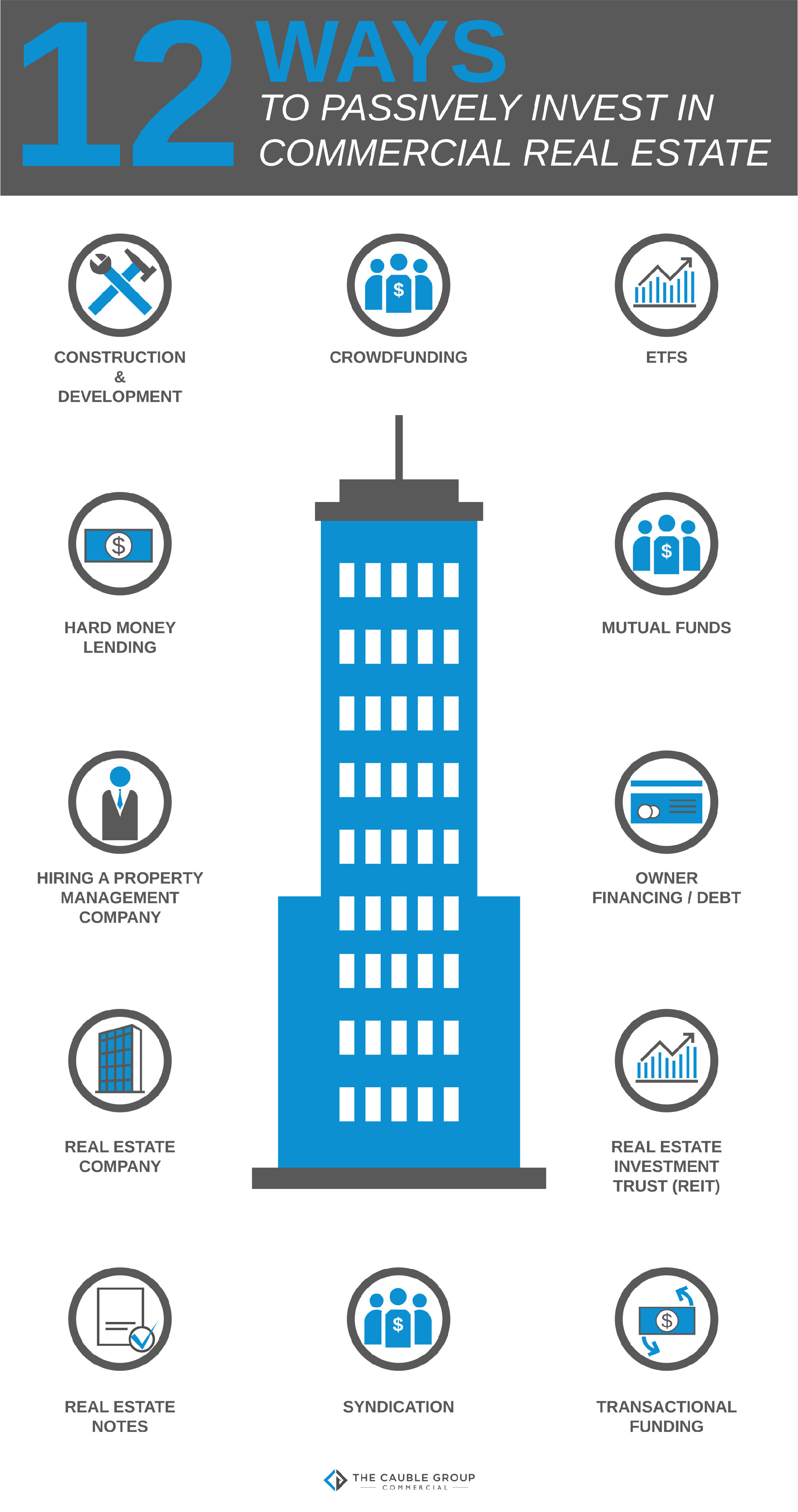

How to Become a Passive Real Estate Investor

Let’s be real - not everyone becomes an investor to give themselves another job.

You may not have the extra time to properly run a deal or maybe you’re simply not interested in the operational side of the investment.

Here are 12 different ways you can become a passive real estate investor.

1. Construction and Development

Invest your capital with a group focused on construction and development.

Real estate developers often need equity partners to acquire the raw land and they’ll find a lender to finance the rest of the project.

They then orchestrate the entire process from conception to delivery while your investment requires no further contribution.

2. Crowdfunding

Crowdfunding sources investment capital from all over the world for various types of commercial real estate investments.

As a potential investor, you basically get to shop through different types of commercial properties, deal structures, projected returns, timelines, etc.

Real estate crowdfunding gives you the opportunity to invest with your laptop without being accredited.

3. Purchase Exchange Traded Funds (ETFs)

Real estate ETFs are typically a compilation of stocks from various REITs.

You get the risk diversification of investing in multiple different REITs, all with different property types and investment strategies, while having the liquidity of a stock.

Just like crowdfunding, you can invest and manage your portfolio from anywhere.

4. Become a Hard Money Lender

Hard money is private money typically used for a very short term.

Real estate investors will utilize hard money when they have to close on a quicker timeline than traditional funding could accommodate or if they are unable to qualify for traditional financing on the project.

Hard money lenders charge points on the front end, higher interest rates, and have the ability to foreclose on the property if necessary.

5. Hire Property Management

Maybe you already own commercial real estate and you’re looking for a way to free yourself from the day to day operations of the property.

If that’s the case, or you just prefer to not have partners, hiring a property management company is the way to go.

They will oversee the project from tenant relations to tax returns, allowing you to step away.

6. Buy Mutual Funds

Real estate focused mutual funds are similar to ETFs in the sense that they can purchase stock in REITs, real estate related ventures, or both.

They are a lower cost alternative to passive real estate investing for new and seasoned investors, alike.

They are also fairly liquid, compared to other real estate investments.

7. Owner-finance your Properties

Tired of dealing with tenants and property management but enjoy the monthly income?

You could sell your buildings to new investors and owner-finance them.

Owner-financing saves you from taking a big tax hit, keeps that monthly cash flow coming through the door, and could help you command even higher prices for the real estate.

8. Invest in a real estate-focused company

Put your money directly in play by investing with a local real estate firm.

This firm could be focused on brokerage, management, development, or simply investment - it’s totally up to you.

Not only will you have boots on the ground actively looking for new projects, you’ll be the first to know if any of the clients of those companies are looking to sell.

9. Purchase Shares of a Real Estate Investment Trust (REIT)

REITs own or finance various types of real estate.

Similar to ETFs and mutual funds, you’re not actually a property owner - you simply hold shares of that company.

They’re also a phenomenal way to diversify your risk since they often hold assets with different types, classes, and locations.

10. Hold Real Estate Notes

When real estate investors buy property with leverage, that debt is secured by a note.

Banks will sell these at major discounts (sometimes between 5% and 50% or more) because the mortgagee is non-performing.

You can either work out a payment plan with the property owner or foreclose and take control of the project yourself.

11. Join in on a syndication

Real estate syndicates are an excellent way to scale a portfolio.

The operator finds the deal, pitches it to equity investors (you), and runs the entire project from acquisition to disposition.

Syndication can be exciting for some investors because it opens the door to investing as a limited partner within your market on larger projects.

12. Transactional Funding

Not all real estate investments are intended to be held for the long term.

Some projects will be acquired by wholesalers, who will purchase the property in the morning and sell it to an investor in the afternoon.

Transactional funding is the money for in between closings that helps these investors acquire the property and is intended to be a very short-term loan.

About The Author:

Tyler Cauble, Founder & President of The Cauble Group, is a commercial real estate broker and investor based in East Nashville. He’s the best selling author of Open for Business: The Insider’s Guide to Leasing Commercial Real Estate and has focused his career on serving commercial real estate investors as a board member for the Real Estate Investors of Nashville.

![How to Become a Passive Real Estate Investor [Infographic]](https://images.squarespace-cdn.com/content/v1/5c115fec9d5abbba78a23c93/1591064368229-O5W4RMXIXIRGGTRUJEI1/image-asset.jpeg)

If you're serious about real estate investing, it's time to look beyond those quaint single-family homes.

Bold statement? Absolutely. But stick with me here.

Now, don't get me wrong. Investing in a single-family home beats twiddling your thumbs on the sidelines of the real estate game. And yes, I'll even go out on a limb and say that residential real estate still outshines many other investment vehicles out there.

But that's not why we're here today, is it?

I'm about to lay out five reasons why commercial real estate should be your go-to play.