We spend a lot of time mulling over numbers and attempting to figure out how the market will trend and how our projections look for certain areas, etc. Real Estate Investors and Brokers spend most of their time - some would argue all of their time - predicting the future for properties or areas where they own or lease real estate.

There’s something known as the “Real Estate Cycle” and it’s basically a supply-and-demand concept, or, in real estate terms, the occupancy and vacancy rate. That’s the local side of the real estate cycle. If the vacancy is high, there is a good chance building a new location to house certain businesses or tenants will pay off, because they need a new location. Vice versa, if occupancy is high, it might not be the right time to build a new building when most businesses already have a location from which they work.

There’s also a financial side to these cycles. They are based on capital flows. In the most simple terms, if a large number of people want to buy property, the price will increase, and the inverse, if buying is slow, the price will drop.

But these cycles go into more detail.

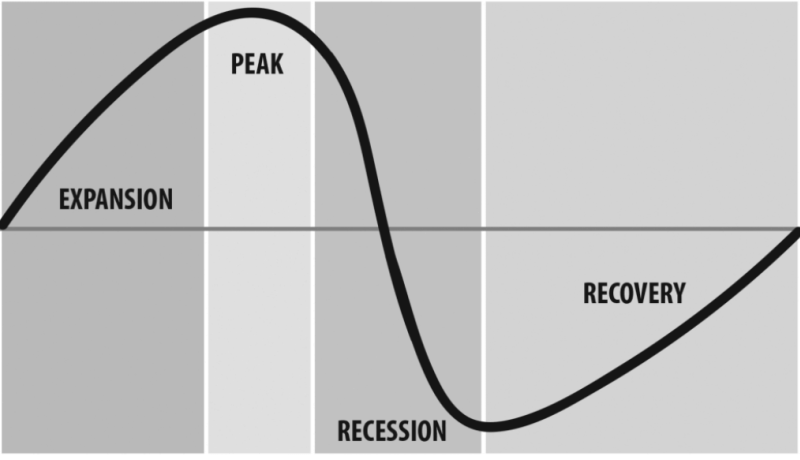

There are four phases a real estate cycle. They are Recovery, Expansion, Hyper Supply and Recession.

Recovery -

The recovery phase of the cycle can very easily be overlooked because most of the time the market still is slow. This phase will still have very low occupancy rates and won’t look like much. Those who pay attention to the data, however, will begin to see a slow upward trend of occupancy rates during this time. Forbes states best saying, “During recovery, value-add properties with some need for renovation require careful evaluation but can present an opportunity to acquire, improve and then resell the asset for strong returns during the upcoming expansion phase.”

Expansion -

Nashville has been expanding for the better half of the past decade, and it doesn’t seem to be slowing much. This phase is where everything looks amazing for Investors and Brokers - and construction works and just about everyone else. This is when you see a major uptick in the demand for property. Old buildings will be bought and new buildings will be constructed. This is the peak for most supply-and-demand numbers.

This is the best time to start value-add operations. It’s much “easier” to renovate an office rather than build a new one.

Hyper Supply -

This is when Investors will begin to see a downward trend in demand. The economy that was once booming will begin to decline, which causes the rate of occupancy to fall. This isn’t the end of the world for Investors, however. This is when they begin to look for stable tenants and give long-term leases to continue cash-flow during the slow times. The key is to be on the lookout for this phase to begin. It’s not easy to see when we’ve reached an equilibrium in our supply-and-demand back in the Expansion phase.

Recession -

This is inevitable. That doesn’t mean all the markets will crash and we will all be out of jobs. During the Hyper Supply stage, it’s important to keep an eye on the amount of supply we are creating for the slowing demand. If we can keep an eye on that, the recession can be “somewhat” avoided. It won’t completely be avoided, just like any market, there are good times and slow times.

It’s important as an Investor to keep a close eye on the market trends and what is to come.

It’s important to remember that each city is different. While Houston seems to be in the Hyper Supply stage in the Office Market, Nashville is still in its Expansion phase - but even Nashville is beginning to peak whereas cities like Indianapolis and Denver are still moving steadily in the Expansion phase.